Cold Chain Logistics: Powering Asia’s Biopharma Boom

FedEx APAC President Karen Reddington explores the rapid development of Asia’s healthcare industry and the increasing demand for biopharmaceutical coldchain delivery solutions.

And the need for these services is growing rapidly. With rising incomes and an improving reimbursement landscape, patients increasingly have the means to afford the newest and most effective biopharmaceuticals. Meanwhile, regulators are streamlining their approvals processes to ensure that novel biopharmaceuticals and biosimilars are brought to market more quickly than before.

Healthcare industry executives are generally optimistic that these trends will continue. In a survey by the Economist Intelligence Unit, nine in ten respondents expected multinational manufacturers with new or specialized pharma products to introduce them in Asia over the next five years.[1]While biopharmaceutical treatment rates in Asia are still relatively low compared to the United States and Europe, the gap will undoubtedly narrow over time.

Many of the most cutting-edge biopharmaceuticals, from the newest monoclonal antibodies to the emerging generation of cell and gene therapies, will come first to the region’s most mature healthcare markets, such as Japan, Singapore, Australia and South Korea. These same markets may also prove receptive to biosimilars, particularly as growing aging populations and chronic diseases put healthcare budgets under pressure, creating demand for low-cost alternatives.

Most industry observers also expect that biosimilars consumption will take off in emerging markets, such as China and India. In China, the biosimilars market is expected to quadruple in size from $2 billion to $8 billion in 2025, according to a report by McKinsey & Company.[2] The India market will experience a similar boom, growing from $400 million to $1.4 billion over the same time period.

An emerging hotbed for advanced manufacturing

One major production hub is Singapore. The city-state offers a balanced mix of socio-political stability, skilled labor, infrastructure, regulatory leadership and research excellence to support biopharmaceutical manufacturing. Many of the world’s top biotech firms, such as Amgen and AbbVie, operate major production sites in the city-state. The same is true for regional leaders such as WuXi Biologics, which chose Singapore as the site for its tenth manufacturing facility last year.[3]

South Korea is fast becoming a major production hub too. The country is home to Samsung Biologics, which recently became the world’s largest contract manufacturer of biopharmaceuticals after completing a $759 million plant outside of Seoul.[4] Meanwhile, Japanese firms are moving aggressively into the cell therapy space, suggesting the country will accelerate production growth in cell biopharma in the future.[5]

China is also gaining attention as an emerging hub for biopharmaceutical manufacturing. While still a relatively small player in the global context, many manufacturers are building local facilities to capture massive opportunities in the domestic market. Some also see China as a destination for contract manufacturing of biologics and biosimilars—roughly 85% of local producers forecast to export biologics to Western markets in the next 5 years.[6]

A changing landscape for clinical trials

Cell and gene therapies are on the rise in the region’s more developed markets, particularly as countries like Japan and Australia make progress towards approvals and reimbursement for the emerging generation of CAR-T therapies.[7] The CAR-T and other cell therapies have a shorter shelf life and require more stringent temperature controls than other biologics, making reliable and close loop cold chain services all the more vital for quality-control.

Another major shift is China’s rapid rise as a drug development hub for biopharmaceuticals. The country already holds a leading position in the global cancer cell therapy pipeline, with 305 of 1,011 active agents under development.[8] Foreign pharmaceutical companies are projected to increase their R&D spend in the country to $29.3 billion in 2021.[9]

Implications for cold chain logistics

With rapid growth in Asia’s biopharmaceutical cold chain, it is critical for biopharmaceutical companies and contract research organizations to select reliable logistics partners. To find the right logistics provider, ask yourself these questions:

- Do they have the necessary infrastructure to ensure shipment integrity at any temperature range and to any location?

- Can they offer the convenience of a one-stop shop with a full range of solutions for freight and parcel shipments at all levels of temperature control?

- Do they deliver high-performing, innovative packaging technologies and services, giving you confidence that product integrity is maintained during transit?

- Are they strong in regulatory compliance to help you meet GDP (Good Distribution Practice)?

As regulators across Asia are putting greater focus on biopharmaceutical logistics, complying with country-level requirements will be especially important. Logistics providers must be sure to follow Standard Operating Procedures, including thermal mapping, management reviews, corrective and preventative actions, temperature documentation, deviation reporting, and proactive contingency interventions. It is crucial that they employ trained personnel who can process monitoring, controls and audits.

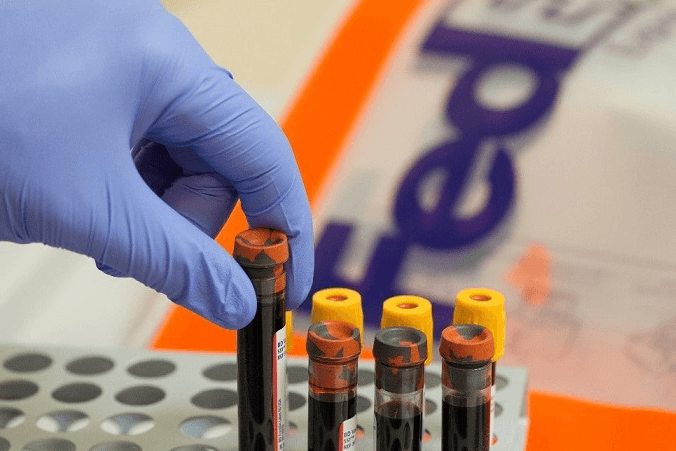

Look for logistics providers that are investing in infrastructure and technologies to support these needs. FedEx, for example, is building new cold chain centers next to airport runways to help guarantee temperature integrity on the pharmaceutical cold chain. As a specialist healthcare logistics provider, FedEx offers innovative packaging solutions, such as the new MedPak VIoC, a high-performance reusable thermal packaging that was launched in Asia earlier this year. In addition, FedEx offers reliable tracking tools like the SenseAware system to ensure continuous visibility through monitoring of temperature, humidity, light exposure, shock events and other environmental factors that can impact biopharmaceutical shipments.

With the healthcare demands of Asia-Pacific evolving as rapidly as the region itself, biopharma companies are entering an era of greater possibilities. Staying on top of tech breakthroughs and consistently leading in product innovation will continue to provide a winning formula. However, exploiting the cutting-edge capabilities of your logistics partner means leveraging an expert network that can strengthen your own.[2] What’s next for biosimilars in emerging markets, an article sourcing from Mc Kinset & Company

[4] Samsung BioLogics claims contract biopharma crown, an article sourcing from Nikkei Asia Review

[5] Japanese firms push into cell therapy, an article sourcing from Chemical and Engineering News

[7] Cell Therapy in the Asia Pacific — Solution to the Cancer Challenge, an article sourcing from KPMG

The Latest

The Latest